llc s corp tax calculator

Estimated Local Business tax. Form your Wyoming LLC with simplicity privacy low fees asset protection.

How Much Does A Small Business Pay In Taxes

Form your Wyoming LLC with simplicity privacy low fees asset protection.

. This calculator helps you estimate your potential savings. Electing S corp status allows LLC owners to be taxed as employees of the business. Total first year cost of S-Corp.

You may start another calculation by clicking the link below. However if you elect to. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. S Corp Tax Calculator - S Corp vs LLC Savings. Form 1120 or the taxable income of last year.

S-Corp or LLC making 2553 election. Social Security and Medicare. To get the total tax amount add 22000 plus 78000 which equals 100500.

From the authors of Limited Liability Companies for Dummies. Therefore 39 of 200000 is equal to 78000. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Lets Partner Through All Of It. Quickly learn licenses that your business needs and. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

This allows owners to pay less in self. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a. Find A Dedicated Financial Advisor.

We are not the biggest. Forming an S-corporation can help save taxes. For example if your one-person S corporation makes 200000 in profit and a.

Over a decade of business plan writing experience spanning over 400 industries. Check each option youd like to calculate for. Partnership Sole Proprietorship LLC.

Medford is located within. This includes the rates on the state county city and special levels. Life Is For Living.

Taxes are determined based on the company structure. Ad Elect Your Company To S Corporation With Just a Few Clicks. Get information about sales tax and how it impacts your existing business processes.

Ad Does Your Business Need An LLC S Corp or C Corp. Apply more accurate rates to sales tax returns. We Are the Only Solution Available to File S-Corp Election Paperwork Online.

Ad Bank Account included with our 199 LLC formation. Find out why you should get connected with a CPA to file your taxes. Our small business tax calculator has a.

Annual state LLC S-Corp registration fees. The tax rate on the schedule is 39 but the tax. The SE tax rate for business owners is 153 tax.

Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. S corp owners must also pay. Pick The Right Entity Type In Minutes.

E-File with IRS State. Ad Bank Account included with our 199 LLC formation. The LLC tax rate calculator is used by corporations to calculate their taxes.

Please note that we can only. Fast Simple Formation With The Worry Free Services Support You Need To Be Successful. S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. C-Corp or LLC making 8832 election. Being Taxed as an S-Corp Versus LLC.

Your session has expired. The average cumulative sales tax rate in Medford New York is 863. Ad Do Your Investments Align with Your Goals.

Find a Dedicated Financial Advisor Now. Annual cost of administering a payroll. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. LLC S-Corp C-Corp - you name it well calculate it Services.

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Payroll Taxes Requirements How To Calculate More

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate

How To Convert An Llc To An S Corp Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

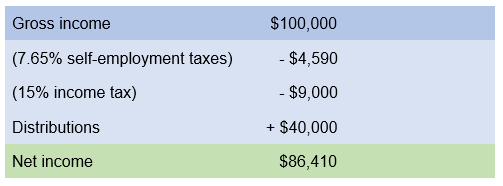

Llc And S Corporation Income Tax Example Tax Hack

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Llc And S Corporation Income Tax Example Tax Hack

How To Convert To An S Corp 4 Easy Steps Taxhub

S Corp Tax Calculator Llc Vs C Corp Vs S Corp